The digital revolution is transforming the financial world, and digital dollars are at the forefront. As traditional banking evolves, the integration of digital currency is reshaping how we manage our finances daily. From seamless transactions to innovative banking solutions, understanding the changes brought by digital dollars is crucial. Explore how they are altering conventional banking and what the future holds.

Understanding the Rise of Digital Dollars

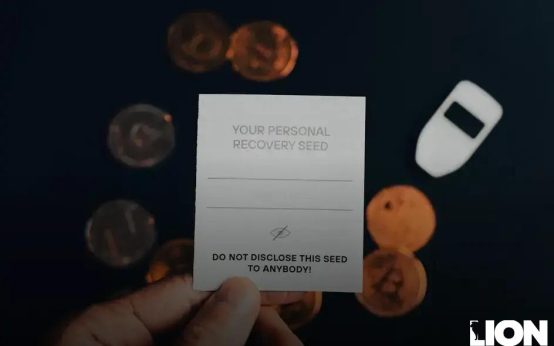

The increasing popularity of digital dollars has been reshaping the landscape of banking. Unlike traditional currency, digital dollars are entirely electronic, stored and managed using digital wallets. This transformation is not mere speculation; it reflects a significant shift in how people and institutions handle money.

One key aspect is convenience. Digital dollars enable quick and easy transactions across the globe without hefty fees. Many people find this especially beneficial for international transfers.

Another important facet is accessibility. Digital currency can be accessed and used by anyone with a smartphone, broadening financial inclusion to those without access to traditional banking services. This change is pivotal for populations in remote or marginalized areas.

Security is also a priority. Digital dollars utilize advanced encryption techniques making them secure against fraud and theft. This level of security is reassuring for users transitioning from cash-based systems.

Moreover, the rise of digital dollars supports sustainability. By reducing the need for physical resources to mint coins and print bills, the shift towards digital reduces environmental impact.

These aspects indicate a profound change in the financial ecosystem. As digital dollars become more integrated into everyday banking, they reshape how individuals interact with their money.

The Future of Everyday Banking with Digital Currency

Imagine a world where transactions happen instantly, and accessing your funds feels as seamless as sending an email. With digital currency, banks are revolutionizing traditional processes, offering customers a more efficient way to interact with their money. Everyday banking is becoming more agile, and digital dollars play a central role in this transformation.

One of the key advantages is reduced transaction times. Transfers that usually take days can occur in seconds, enhancing the speed of commerce and daily financial management. Customers can enjoy greater financial fluidity, making it easier to manage expenses and investments.

Moreover, digital currencies are enhancing security in banking. Blockchain technology ensures that every transaction is encrypted and tamper-proof, providing a level of trust and safety previously unattainable. This transparency can reduce fraud and build consumer confidence in using digital financial solutions.

Banks are also seeing operational benefits. By utilizing digital currency, they can reduce processing costs and admin overheads associated with traditional banking methods. This means potentially lower fees for consumers and the ability for banks to offer more competitive financial products and services.

Financial inclusion is also a significant consideration. Digital currencies can reach unbanked populations, providing them access to banking services without the need for physical branches. This can empower individuals in under-served regions, fostering economic growth and stability.

The shift towards digital currency isn’t just a technological upgrade; it’s a step towards a more inclusive and efficient financial system. As we move forward, understanding the intricacies of this change will be essential for both banks and customers to maximize potential benefits.

The Investing Strategy Most Millionaires Use in Their 20s

The Investing Strategy Most Millionaires Use in Their 20s  The Future of Wealth: AI’s Role in New Investor Class

The Future of Wealth: AI’s Role in New Investor Class  The Secret to Making Your Money Work 24/7: Unlock Wealth

The Secret to Making Your Money Work 24/7: Unlock Wealth