Welcoming a baby is a joyful experience, but it requires careful financial planning. Understanding how to financially prepare for having a baby can ease this transition. Begin by assessing your current financial status, ensuring you’re ready for the new responsibilities. Consider creating a detailed budget to anticipate all costs associated with your newborn. Building an emergency fund will help you handle unexpected expenses. Finally, insurance options can provide financial security. Learn more in the sections below.

Assessing Your Current Financial Situation

To adequately prepare for the financial demands of having a baby, begin with an in-depth examination of your current financial situation. Start by compiling a comprehensive list of all income sources, including salaries, bonuses, or any side hustle revenues. Next, account for all monthly expenses, such as utilities, groceries, rental/mortgage payments, and any debts you may have, including credit cards or student loans.

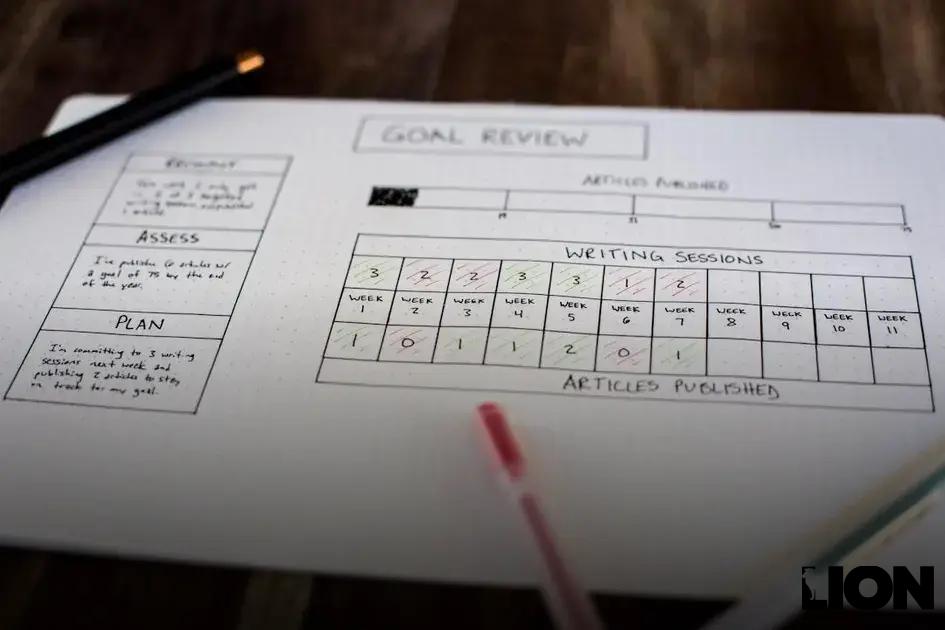

It is crucial to have a clear picture of your cash flow to identify potential savings or expense reduction areas. Analyze spending habits to discover discretionary spending that can be minimized or eliminated. Reviewing bank statements and using budgeting software can facilitate this process, providing clarity and foresight for financial planning.

Additionally, consider any upcoming financial changes that could impact your budget. For instance, if one partner plans to take parental leave, explore how this might affect your family income. It’s essential to anticipate these changes and incorporate them into your financial review.

Moreover, evaluate your current savings and assess whether they can cover added expenses associated with having a baby. If you do not have an emergency fund, now is the time to start building one, as unexpected costs often arise with a new addition to the family. By thoroughly understanding your financial standing, you’ll be better prepared to make informed decisions as you budget for your growing family.

Creating a Baby Budget

Establishing a baby budget can help eliminate financial stress and provide a clear roadmap for expenses. Begin by listing out essential baby items like diapers, clothing, formula, and childcare. It is important to differentiate between one-time purchases, like a crib, and recurring costs, such as diapers. This approach ensures all necessary expenses are considered.

Allocate your monthly income and prioritize these costs. Creating a detailed budget with specific categories can help manage expenses efficiently. Consider utilizing budget sheets that define fixed and variable costs. By planning effectively, you mitigate the risk of financial surprises.

Don’t overlook long-term expenses like education and health care. Begin saving for these future necessities by setting aside a portion of your income. Moreover, evaluate current subscriptions and memberships to see where savings can be achieved. Redirect these funds towards your growing family’s needs.

Lastly, track your spending regularly. Monitoring allows you to make necessary adjustments and stay on budget. With dedication and planning, creating a practical baby budget becomes a manageable task.

Building an Emergency Fund

Building an emergency fund is a critical part when preparing for a new addition to your family. Having a financial cushion can significantly ease your mind and help cover unexpected expenses that may arise. The primary goal should be to save three to six months’ worth of living expenses in your emergency fund. Here’s how you can start:

- Set a realistic goal: Determine how much you can efficiently save each month by evaluating your current income and expenses.

- Cut unnecessary expenses: Review your monthly spending and reduce discretionary expenses. Consider cooking at home more often or canceling subscriptions you rarely use.

- Automate your savings: Set up an automatic transfer from your checking account to a dedicated savings account. Keeping these funds separate helps resist the urge to use them for other expenses.

- Start small: If saving three to six months of expenses seems overwhelming, start with a smaller, more attainable target, like one month of expenses, and build from there.

- Consider side income: A part-time job or freelance work can boost your emergency fund faster. Explore options for extra income that align with your skills and schedule.

Prioritizing and steadily building your emergency fund offers financial security and peace of mind as you prepare for your growing family’s needs.

Exploring Insurance Options for Your New Family

When planning for a new family, exploring the right insurance options is crucial for financial security. Health insurance should be at the top of your list. Evaluate your current health plan to ensure it provides adequate coverage for prenatal and postnatal care. Look into options offered by your employer, as well as private plans if necessary.

Life insurance is another critical consideration. It ensures that your family is protected financially if you are no longer there to provide support. Consider term life insurance to cover the duration when your children are dependent on you financially.

Additionally, disability insurance can protect your income in case you are unable to work due to an illness or injury. Review policies to see if they offer sufficient coverage for your income level.

Examine whether you need additional coverage such as dental and vision insurance for your expanding family. These plans can help to mitigate out-of-pocket costs for routine and unexpected medical expenses.

Finally, review and update beneficiary information on all your insurance policies to ensure they align with your new family structure. This will provide peace of mind that your loved ones are cared for financially, regardless of what the future holds.

The Best Financial Tips for Single Parents: Unlock Success

The Best Financial Tips for Single Parents: Unlock Success  Stock Market Basics: A Beginner’s Guide to Investing Wisely

Stock Market Basics: A Beginner’s Guide to Investing Wisely  How to Set and Achieve Financial Goals Easily Now

How to Set and Achieve Financial Goals Easily Now